FAQs

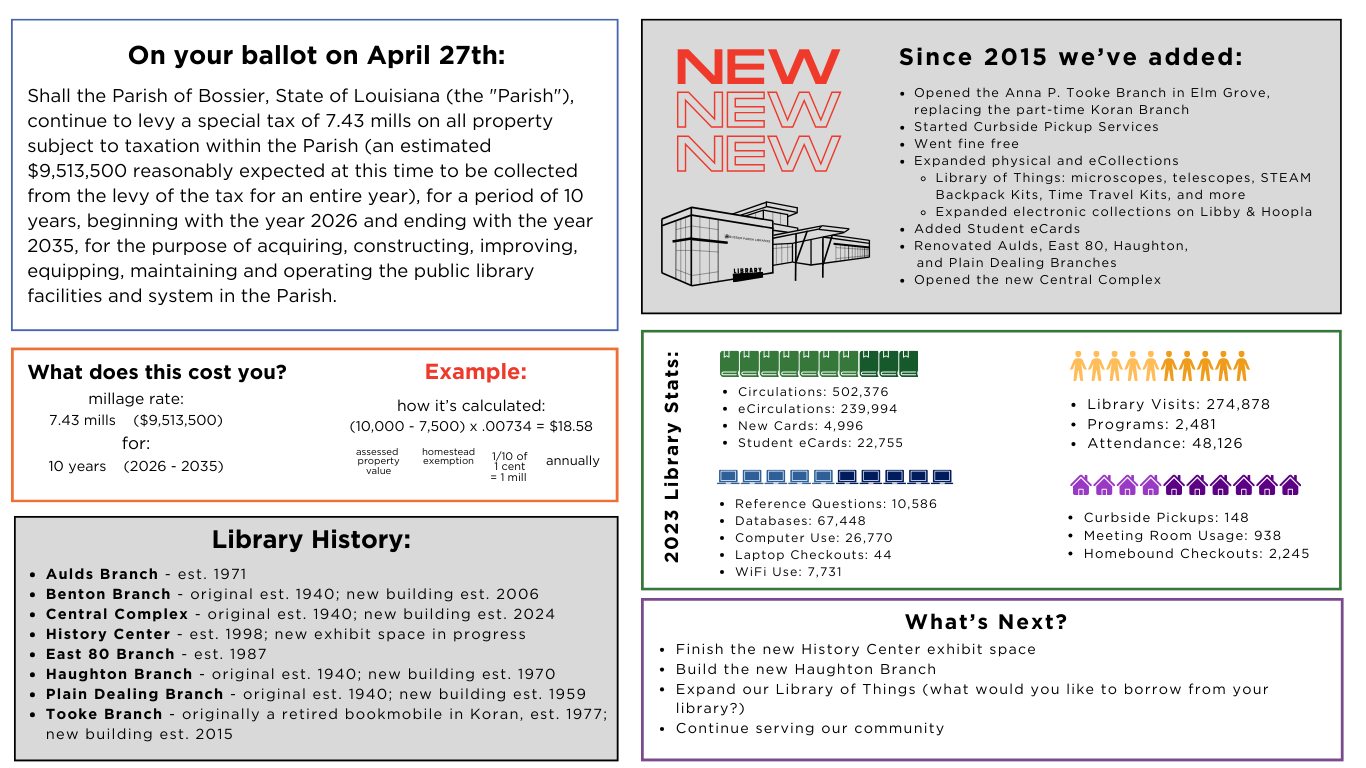

Shall the Parish of Bossier, State of Louisiana (the "Parish"), continue to levy a special tax of 7.43 mills on all property subject to taxation within the Parish (an estimated $9,513,500 reasonably expected at this time to be collected from the levy of the tax for an entire year), for a period of 10 years, beginning with the year 2026 and ending with the year 2035, for the purpose of acquiring, constructing, improving, equipping, maintaining and operating the public library facilities and system in the Parish.

A millage or millage rate is the tax rate that applies in the calculation of a specific property tax levy.

millage rate:

How it's calculated:

assessed property value - homestead exemption x .00734 = annual cost

Example:

(10,000 - 7,500) x .00734 = $18.58 annually

The Bossier Parish Library System has been funded by property taxes since June 1941, when the Bossier Parish Police Jury approved the library on a permanent basis with the passage of a one-half millage.

Everything related to the public library, including staffing, operations, building maintenance, materials to check out, etc. Some things we've accomplished since our last renewal:

- Opened the Anna P. Tooke Branch in Elm Grove, replacing the part-time Koran Branch

- Started Curbside Pickup Services

- Went fine free

- Expanded physical and e-Collections, including Library of Things: microscopes, telescopes, STEAM Backpack Kits, Time Travel Kits, and more

- Added Student e-Cards

- Renovated Aulds, East 80, Haughton, and Plain Dealing Branches

- Opened the new Central Complex